Interest Rate Landscape: Fix and Flip Investor’s Guide

Navigating the Interest Rate Landscape: A Fix and Flip Investor’s Guide

In the realm of real estate, the ebb and flow of interest rates play a significant role in shaping market dynamics and influencing investment decisions. As a private lender specializing in financing for fix-and-flip professionals, Clear Mortgage recognizes the importance of staying abreast of interest rate trends and their potential impact on the fixer-upper market. It is an interesting time. Conventional financing rates have nearly tripled. Institutional rates have doubled. Yet hard money has only moved up a couple of points.

Recent Interest Rate Trends

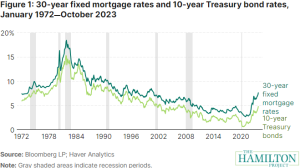

The past few years have been marked by a period of historically low interest rates, a phenomenon that has fueled enthusiasm among homeowners and investors alike. However, recent economic developments, including rising inflation and the Federal Reserve’s efforts to combat it, have led to an increase in interest rates. The margin of the 30 year fixed mortgage over the 10 year treasury is statistically high and is anticipated to come down in the near term as fed uncertainty is reduced.

While this upward trend may raise concerns among some potential buyers, it’s crucial to understand the broader context and recognize that the current interest rate environment remains relatively favorable compared to historical averages. For savvy fixer-upper investors, this presents an opportune moment to capitalize on the existing market conditions.

Why Now is a Good Time to Invest in Fixer-Uppers

Despite the recent interest rate hikes, several factors continue to make fixer-upper investments an attractive proposition for discerning investors:

- Strong Demand for Renovated Homes: The demand for renovated homes remains robust, as buyers increasingly seek turnkey properties that offer modern amenities and updated aesthetics. This trend is fueled by a growing preference for move-in-ready homes, especially among millennials and Gen Xers.

- Potential for Significant Profit: Fixer-upper properties offer investors the potential for substantial profit margins by purchasing undervalued properties, making necessary renovations, and reselling them at a higher market value.

- Diversification of Investment Portfolio: Investing in fixer-upper properties provides investors with a means to diversify their investment portfolios, reducing their reliance on traditional asset classes such as stocks and bonds.

Strategic Considerations for Fixer-Upper Investors

While the current market presents promising opportunities for fixer-upper investors, it’s essential to approach these investments with a strategic mindset and carefully consider the following factors:

- Thorough Property Evaluation: Conduct a comprehensive evaluation of the property’s condition, including structural integrity, potential renovation costs, and compliance with local building codes. Give Clear Mortgage a call and get their thoughts on value.

- Realistic Budget and Timeline: Develop a detailed budget that accounts for all anticipated renovation costs and establish a realistic timeline for completing the project. Clear Mortgage can fund 100% of renovation costs.

- Experienced Team: Realtor, Contractor, Financing. Work with experienced and reputable folks to ensure the quality and timeliness of the renovations and success.

- Market Research: Conduct thorough market research to understand the current demand for similar properties in the area and set an appropriate asking price. Again, Clear Mortgage can help with this.

Clear Mortgage: Your Trusted Partner in Fixer-Upper Financing

At Clear Mortgage, we understand the unique challenges and opportunities associated with fixer-upper investments. That’s why we’re committed to providing our clients with tailored financing solutions that address their specific needs and help them achieve their investment goals.

Our experienced team of professionals offers a streamlined application process, competitive interest rates, and flexible financing options to support your fixer-upper endeavors. Whether you’re a seasoned investor or just starting out, Clear Mortgage is here to guide you through the process and help you navigate the ever-evolving landscape of real estate investment.